Bitcoin Halving

Discover the next Bitcoin halving dates, what is Bitcoin halving, what is the Bitcoin 4-year cycle and tips to best approach Bitcoin halving.

Bitcoin halving countdown

The Bitcoin halving countdown displayed is merely indicative, as the precise date of the next halving depends on the rate of block creation, which varies per day.

What is a Bitcoin halving?

Bitcoin halving explained

Bitcoin halving happens around every four years and reduces by half the reward for mining new Bitcoins. Each halving decreases the number of new Bitcoins awarded to miners for each block mined. The periodic halvings control new Bitcoin supply, fight inflation, and keep Bitcoin scarce. Satoshi Nakamoto integrated it into Bitcoin's design, limiting total coins to 21 million.

What does it mean for you?

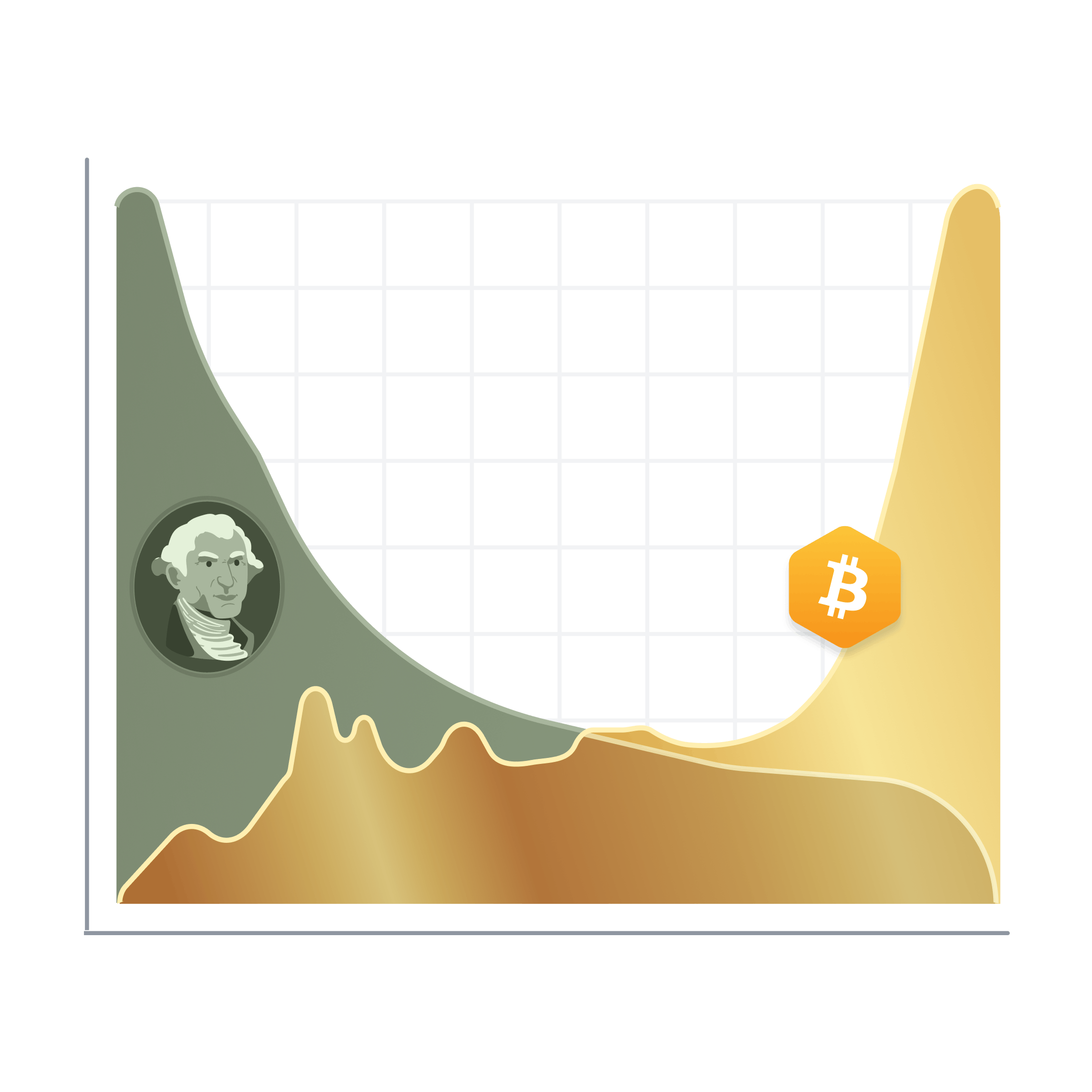

Bitcoin Halving plays a central role in controlling the amount of new Bitcoin introduced into the market, making the cryptocurrency more akin to a store of value like gold rather than a fiat currency. It boosts value, curbs inflation, and encourages mining, potentially raising prices with high demand.

Why the months prior are important

Bitcoin halving can drive up prices by limiting new supply, but it also reduces miner earnings and could impact network security, potentially affecting Bitcoin's stability.

Bitcoin halving dates

To date, 4 Bitcoin halvings have occurred: in 2012, the block reward reduced from 50 BTC to 25 BTC; in 2016, it decreased to 12.5 BTC; in May 2020, it settled at 6.25 BTC; and in April 2024, it settled at 3.125 BTC. The fifth halving is anticipated in 2028, lowering the reward to 1.562 BTC.

Our experts thoughts on the Bitcoin halving

Strategies to prepare for the Bitcoin halving

Step 1 - Buy Bitcoin at the best price

With our Smart Engine, buy Bitcoin at the best possible price.

Download app

Step 2 - Diversify with Best Blockchains

Build your portfolio with the Best Blockchains at the heart of crypto.

Buy Best BlockchainsExclusive tools

Explore exclusive tools only accessible to our SwissBorg community

Auto-Invest

Automate your Bitcoin accumulation today!

Price Alerts

Receive notifications when Bitcoin reaches certain prices.

Frequently asked questions

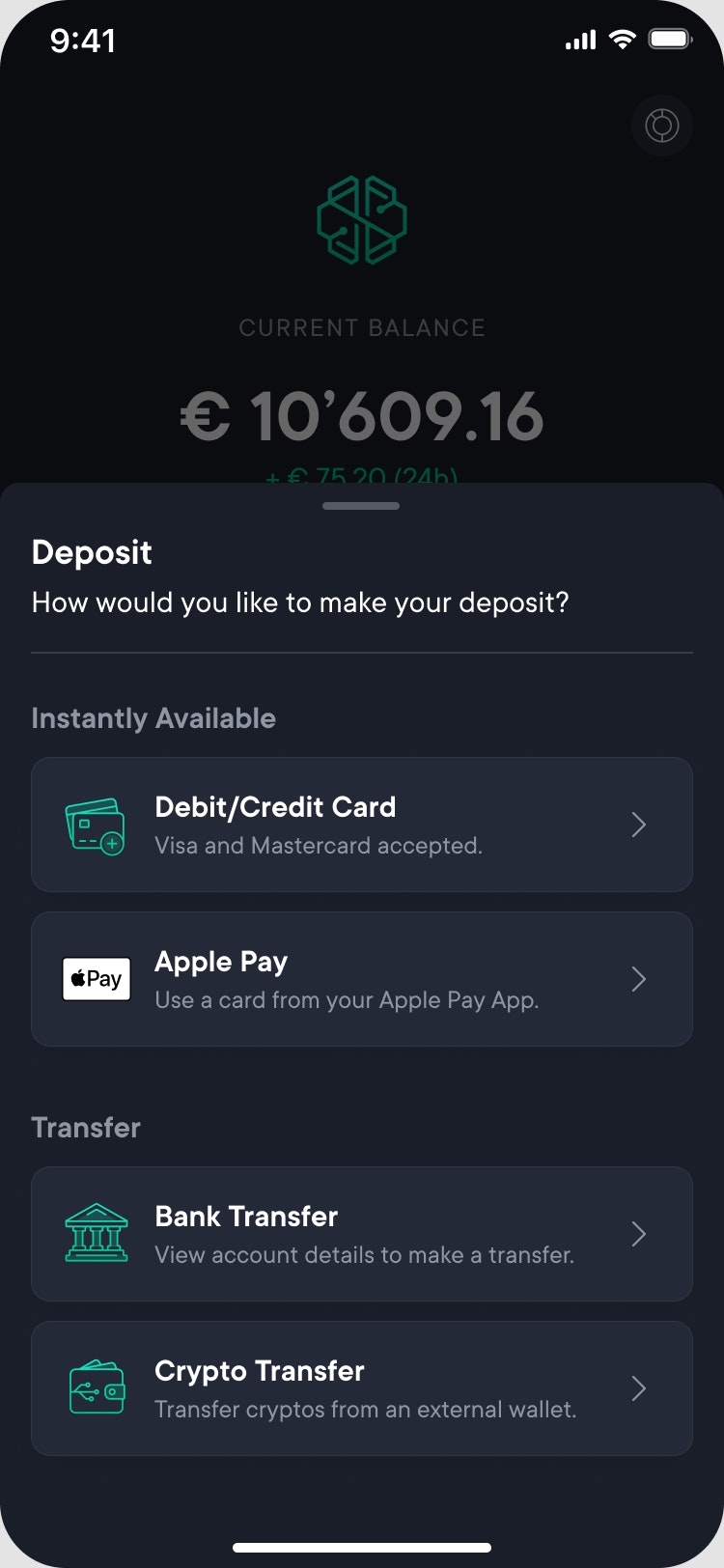

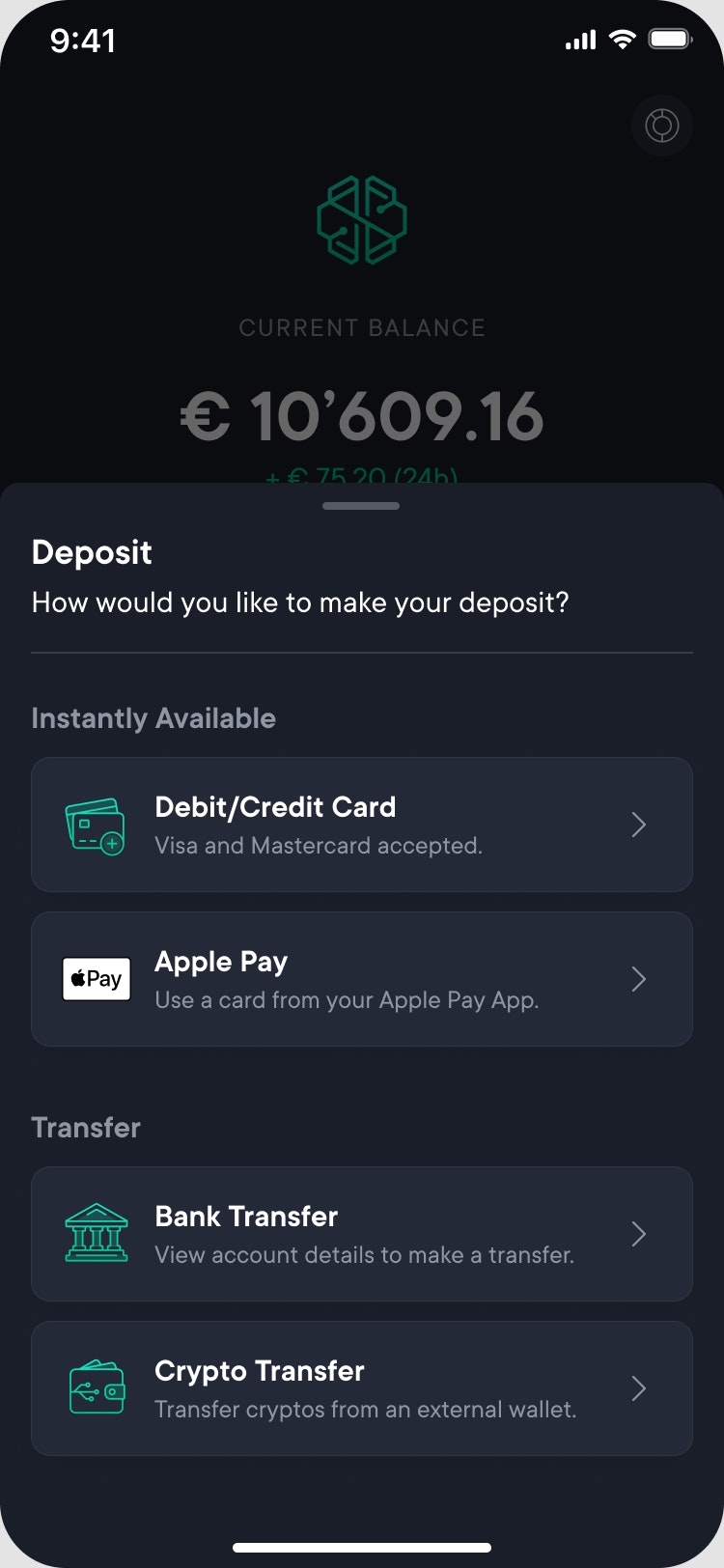

Use your card, add funds, and start investing in seconds!

- Tap Deposit button on the main screen

- Choose “add card’

- Provide card details

- Select the currency and enter amount

- Authenticate payment with 3D Secure