Guide for validators on how to run a Solana node

Introducing Solana nodes and validator roles

Solana has emerged as one of the most prominent blockchain networks, known for its high throughput and low transaction costs. At the heart of this ecosystem are Solana nodes, which form the backbone of the network's infrastructure. A Solana node is a computer that participates in the Solana blockchain network by validating transactions, storing the ledger, and maintaining consensus.

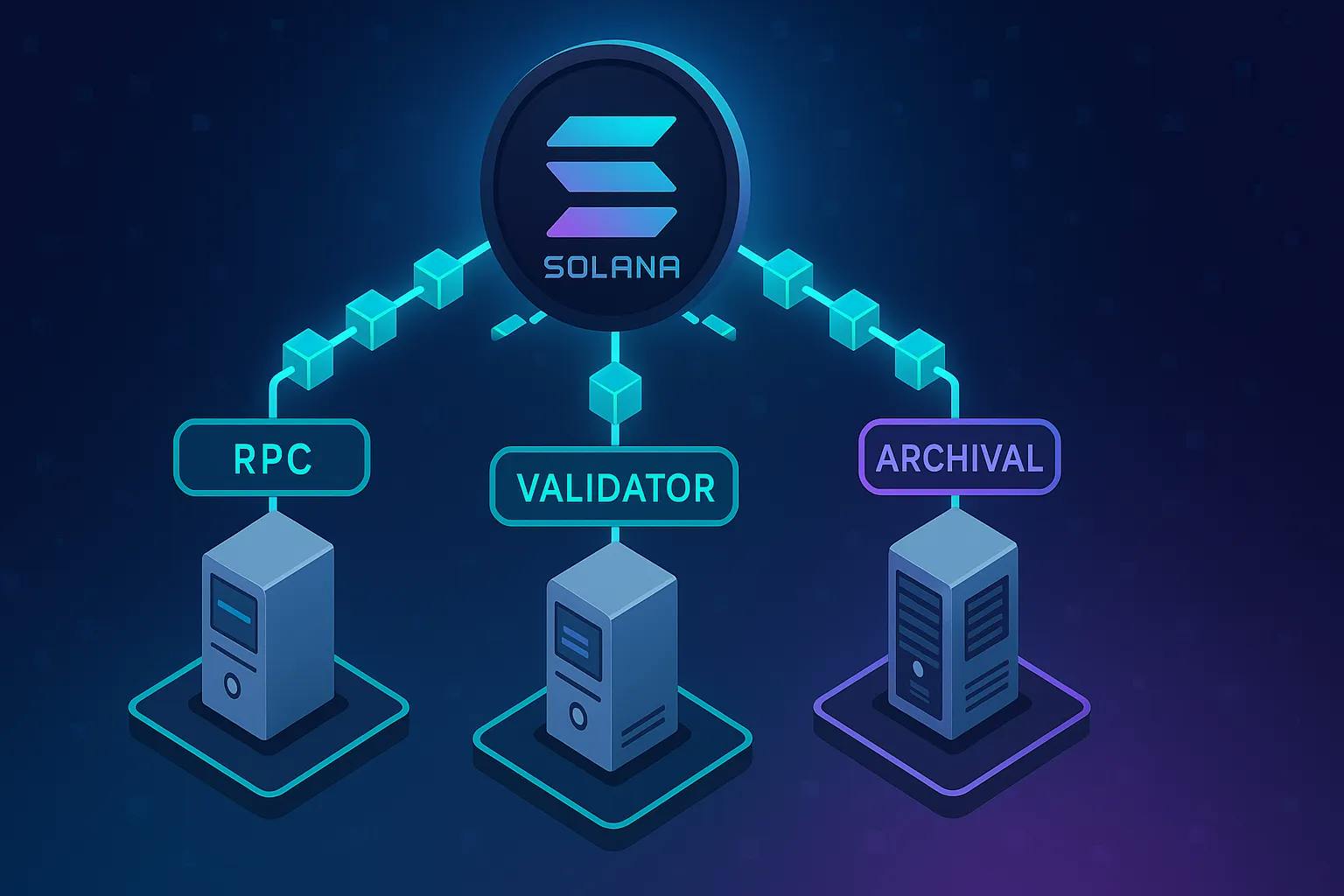

Nodes on the Solana network can assume different roles, each contributing to the overall functionality and security of the blockchain:

- Validators: These nodes actively participate in the consensus mechanism by producing blocks and validating transactions. They stake SOL tokens as collateral to ensure honest behaviour.

- RPC (Remote Procedure Call) Nodes: These provide an interface for applications to interact with the Solana blockchain without running a full validator node.

- Archival Nodes: These maintain the complete history of the blockchain, storing all historical data since genesis.

The Solana network relies on a unique consensus mechanism called Proof of History (PoH) combined with Proof of Stake (PoS). This hybrid approach enables Solana to achieve remarkable transaction speeds while aiming to maintain security and decentralisation.

How to run a Solana node

Setting up a Solana node requires careful planning and execution. The process involves several key steps:

- Select appropriate hardware: Ensure your system meets the current recommended requirements for running a Solana node.

- Install the Solana CLI: Download and install the latest stable version of the Solana command-line interface tools from official Solana documentation.

- Generate necessary keys: Create validator identity and vote account keypairs.

- Configure your node: Set up the necessary parameters for your validator.

- Start the validator: Launch your Solana node and begin synchronising with the network.

To install the Solana CLI, users should always refer to the official Solana documentation for the latest stable version and installation instructions, as software versions are frequently updated. Using outdated versions can lead to incompatibility or security issues.

After installation, generate your validator identity:

solana-keygen new -o ~/validator-keypair.json

Then create a vote account:

solana create-vote-account ~/vote-account-keypair.json ~/validator-keypair.json ~/authorized-withdrawer-keypair.json

Finally, start your validator with the appropriate configuration, ensuring all paths and parameters reflect your setup and the current network requirements (e.g., entrypoints can change and should be confirmed from official documentation at the time of setup):

solana-validator \ --identity ~/validator-keypair.json \ --vote-account ~/vote-account-keypair.json \ --ledger ~/validator-ledger \ --rpc-port 8899 \ --entrypoint entrypoint.mainnet-beta.solana.com:8001 \ --limit-ledger-size \ --log ~/solana-validator.log

It is worth noting that some liquid staking providers or validator pool services might offer tools or guides to assist with aspects of validator setup, though running an independent validator remains a technically demanding task.

Hardware and staking requirements

Running a Solana node demands robust hardware due to the network's high performance requirements. The recommended specifications (which can be considered minimums for reliable operation) for operating a Solana validator node typically include:

- CPU: 12 cores / 24 threads (or more), 2.8GHz or faster (modern AMD Ryzen/EPYC or Intel Xeon).

- RAM: 128GB DDR4 RAM (with 256GB increasingly recommended for future-proofing and performance).

- Storage: At least a 2TB NVMe SSD (PCIe Gen3 or Gen4) for the ledger, and often a separate NVMe SSD (e.g., 500GB-1TB) for accounts and the operating system. Total storage needs for the ledger can grow significantly over time.

- Network: A 1 Gbps symmetric internet connection with low latency is crucial (10 Gbps is recommended for better peering and performance).

- Power: A redundant power supply with an Uninterruptible Power Supply (UPS) backup is highly recommended for consistent operation.

These specifications are significantly higher than those required for many other blockchain networks due to Solana's focus on high throughput and low latency.

In addition to hardware, validators must stake SOL tokens as part of the network's security model. While there is no protocol-enforced minimum self-stake to run a validator, to be competitive in attracting delegation and to participate meaningfully in consensus to earn consistent rewards, validators typically need a substantial amount of SOL. This amount often runs into the thousands, either as self-stake or attracted from other SOL holders (delegators). A very small self-stake (e.g., 100-1000 SOL) alone is unlikely to make a validator profitable or influential in consensus without significant external delegation.

The substantial hardware and staking requirements represent a significant investment, which can range from $5,000 to $10,000 USD or more for hardware alone (prices vary based on components and region), plus the market value of the staked SOL tokens.

Rewards and incentives for validators

Solana validators receive rewards for their contribution to network security and operation. These incentives come from two primary sources:

- Inflation rewards: Solana has an inflationary monetary policy with an initial inflation rate set at 8%. This rate disinflates (decreases) by 15% year-over-year until it reaches a long-term target of approximately 1.5%. These newly minted tokens are distributed to staked validators and their delegators.

- Transaction fees: Validators, specifically the leader validator for a given slot, receive 50% of the transaction fees from the blocks they process. The other 50% of transaction fees are burned.

The annual percentage yield (APY) for delegating stake to Solana validators typically ranges between 6-8%. However, this figure constantly fluctuates based on several factors including:

- The total amount of SOL staked on the network (network participation rate).

- The current network inflation rate as per the disinflationary schedule.

- The validator's commission rate, which is the percentage of rewards the validator keeps before distributing the rest to delegators (typically ranging from 0-15%, with 5-10% being common).

- The validator's performance and uptime.

Validators must maintain high uptime and excellent performance to maximise their rewards. While there are no direct "penalties" or loss of existing stake for simply missing blocks or having downtime (unlike slashing for malicious acts), poor performance directly results in earning fewer rewards. Slashing, which involves the loss of staked SOL, is reserved for severe cases of malicious behaviour, such as double-signing blocks.

Decentralisation and network security

The decentralisation of the Solana network is directly tied to the distribution and independence of validator nodes. As of May 2025, Solana has over 2,000 to 3,000 active validators. However, the voting power, determined by the amount of SOL staked, tends to be more concentrated among larger, established validators.

To enhance network security and decentralisation, Solana implements and tracks several mechanisms:

- Nakamoto Coefficient: Solana aims to increase its Nakamoto coefficient. This metric measures the minimum number of independent entities (validators in this context) that would need to collude to compromise the network.

- Tower BFT: This is Solana's PoH-optimized version of Practical Byzantine Fault Tolerance, a consensus algorithm that helps maintain agreement even if some validators are malicious or offline.

- Turbine Block Propagation: A protocol designed to efficiently distribute block data across the large network of nodes.

Projects like Pyth Network (an oracle solution) and major DEXs such as Jupiter, Raydium, and Orca, which operate on Solana, benefit from this security infrastructure while contributing to the network's overall utility and value.

Solana vs Ethereum nodes

When comparing the operational aspects of Solana and Ethereum nodes, several key differences become apparent:

Hardware Requirements

- Solana Node: Generally higher (e.g., 128GB-256GB RAM, 2TB+ NVMe SSDs for ledger).

- Ethereum Node: Generally lower (e.g., 16GB-32GB RAM often cited as minimum/sufficient, with 2TB+ SSD commonly recommended for long-term operation).

Transaction Speed (Theoretical Max L1)

- Solana Node: Up to 65,000+ TPS.

- Ethereum Node: 15-30 TPS (Layer 1).

Consensus Mechanism

- Solana Node: Proof-of-History + Proof-of-Stake.

- Ethereum Node: Proof-of-Stake (post-Merge).

Validator Count (Active)

- Solana Node: Approximately 2,000-3,000+.

- Ethereum Node: Over 1,000,000.

Setup Complexity

- Solana Node: Moderate to High.

- Ethereum Node: Moderate.

Operating Costs

- Solana Node: Higher, primarily due to more demanding hardware and bandwidth requirements.

- Ethereum Node: Lower, relative to Solana.

Solana's architecture prioritises performance and scalability on Layer 1, necessitating more powerful hardware but delivering significantly higher transaction throughput. Ethereum, while having generally lower hardware requirements for its Layer 1 validators, benefits from a vastly larger and more distributed validator set, with much of its ecosystem's scalability focused on Layer 2 solutions.

Future of Solana node infrastructure

The Solana node infrastructure continues to evolve with several key developments aimed at improving performance, resilience, and accessibility:

- Firedancer: A new, second validator client implementation being developed by Jump Crypto, with the goal of significantly improving network resilience, performance, and client diversity.

- Stake Pools and Liquid Staking: Solutions like Marinade Finance and Jito are making staking more accessible and capital-efficient for SOL holders through liquid staking derivatives.

- Validator Client Optimisations: Ongoing improvements by Solana Labs and other contributors to the existing validator client (Solana Labs client) to reduce hardware requirements where possible and enhance performance.

- Regional Decentralisation: Continuous efforts to encourage broader geographic distribution of validators to enhance network resilience against regional disruptions.

As the Solana ecosystem expands, the node infrastructure will likely become more robust through innovations in hardware efficiency, client software optimizations, and evolving staking mechanisms. Projects like Raydium and Orca, which provide essential DeFi services on Solana, will benefit directly from these improvements through enhanced network stability and throughput.

In conclusion, running a Solana node represents a significant commitment in terms of technical knowledge, hardware resources, and financial investment. However, for those with the necessary capabilities and resources, it offers an opportunity to participate directly in securing one of the fastest-growing blockchain networks while earning rewards for their contribution.